If you have visited any country in Asia recently, you have probably seen it. Turn your head in any direction; stand up; go shopping; or check an app on your phone and you will notice products from Western companies lurking about. Some of these products are nearly identical to their counterparts overseas, and others are brand new, launched specifically for the local market.

As more and more companies are taking their products abroad, the need for user research in these new markets is increasing in importance. I spent a year spanning 2010 and 2011 living in Hong Kong and leading user research campaigns—primarily in China, Japan, and India. Through a healthy balance of trial and error (and more error), I learned a lot about leading these studies in cultures incredibly different than my own. Meta understanding with a bit of methodology mixed in, I offer you my top five lessons learned while conducting and applying user research in Asia.

1) Understand the Enhanced Impact of Recent History

Recent history is experienced and interpreted differently everywhere you go. If you can understand the impact of recent events, you will learn what forces have shaped people and how those forces affect their behavior and attitudes as related to your product.

Let’s look at China as an example. Its modern knowledge workforce—the people who are the most likely the target audience of Western companies—has experienced a huge range of historical events.

The Great Leap Forward, a five-year economic plan devised by Mao Zedong to collectivize farmers and aggressively transition the country into one that had the technology to rival the West, failed at a massive scale. It led to the Great Chinese Famine, when 45 million people starved between 1960 and 1961.

Between 1966 1976, China underwent the Cultural Revolution. In order to eradicate culture and any capitalism from the country and ensure socialism prevailed, scholars, doctors, and the literati were forced from cities into rural areas and cultural and religious artifacts were destroyed. Some literati escaped to Taiwan, Hong Kong, Macau, and Singapore. This full decade of dissolution of thinkers is evidenced in the demographics of the workforce of today.

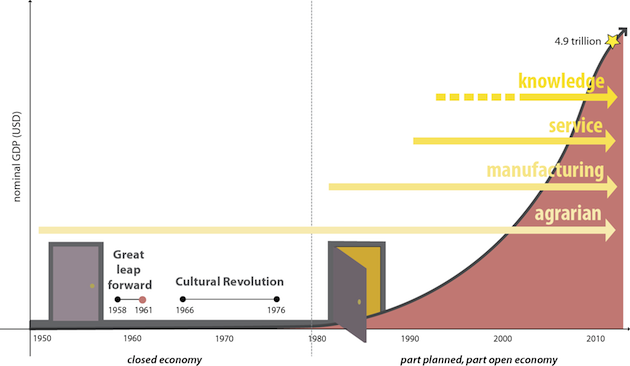

Between 1949 and 1979, China was a communist country with a closed, mostly agrarian economy. Essentially, everything was assigned and controlled by the government. Innovation and entrepreneurship did not exist. In 1979, the country opened its economy to private enterprise and foreign investment and as a result, all parts of the economy (agrarian, manufacturing, service, and knowledge) began evolving rapidly, and all at once.

China’s recent history, highlighting the Great Leap Forward, Cultural Revolution, opening of the economy, and rapid co-evolution of agrarian, manufacturing, service, and knowledge economies.

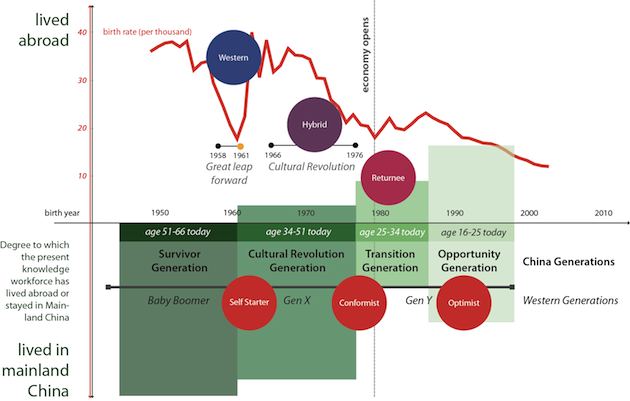

Interestingly, it’s the impact of recent history in China plus the time, if any, spent living abroad that shapes the individuals that make up China’s modern knowledge workforce. The following figures highlight six archetypes present in the modern Chinese knowledge workforce. These are the people that are the target of most Western companies making their way into the Chinese market.

Six archetypes of worker found in the modern Chinese knowledge workforce.

Further detail on the demographics of the modern Chinese knowledge workforce in combination with time spent living abroad or in mainland China.

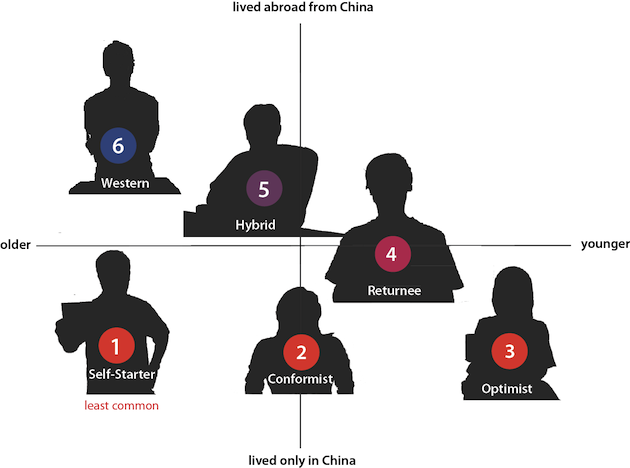

Self Starters were born before and during the Cultural Revolution and lived through the hardest parts of communism. They have lived only in Mainland China, are generally conservative, are focused on social displays of success, and were immediately entrepreneurial when the economy opened up in 1979. Self Starters run Chinese companies and believe in hiring local, not foreign, talent.

Conformists were born during and just after the Cultural Revolution, have lived only in Mainland China, and accept communism and the information provided to them by the government. They work at Chinese National companies.

Optimists are part of the Opportunity Generation, born after 1987, and are all products of the one-child policy. They have only lived in Mainland China but may have Western exposure through employment with a multi-national company. Generally pleased with life in China, this group has expendable income and spends a great deal of time online.

Returnees were born on the cusp of the economy opening in 1979. Born and raised in Mainland China, they headed overseas to countries like Australia, the U.S., Canada, or the UK for education, and have since returned to live in China. Because of their East/West understanding, this group is sought after by both Chinese and multi-national companies, and often seeks social value with their work.

Hybrids are individuals of Chinese descent that were born, raised, and educated in Taiwan, Hong Kong, Macau, Singapore, or Malaysia, but now live in China. Slightly older than Returnees, this group is also highly sought after by multi-national companies and fills a high-level management gap left by the dissolution of thinkers from the mainland population during the Cultural Revolution.

Westerners were born, raised, and educated in Western countries, and now live permanently in China. Often, they are sent abroad by their company to manage a branch office.

When researching and designing for the Asian market, understand the events that have shaped your target users. How does this affect their behavior or attitudes as related to your product?

2) Find the Momentum of the Population

Find the source of cultural momentum for your target users and a way to tap into it, keeping in mind what roles religion and politics might play.

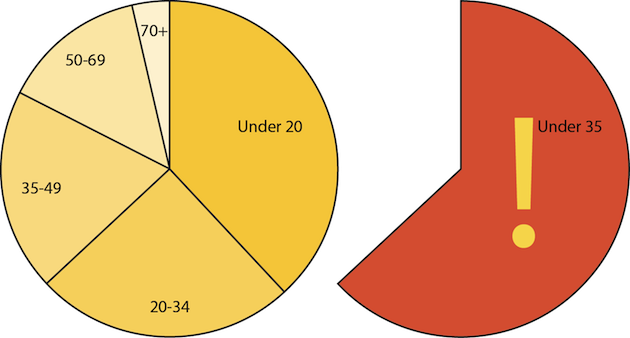

For example, India has the world’s largest youth population. The 800 million people under age 35 are hyper-aware that they are living in a special time in the history of their country. Economically restructured in 1991, India is growing rapidly and a self-propelling change is seen in the economy and culture.

Out of India’s 1.2 billion people, 800 million are under age 35. India has the world’s largest youth population.

Tradition and religion in combination with the economy have sparked a “fire in the belly” that instills an entrepreneurial drive that isn’t just for those that want to start their own companies. Most Indians bring it to work with them no matter where they are employed. Individuals look to find the best jobs and advance within their companies. Many take classes online outside of work on their own time, even if it is not something necessary for their jobs. The desire to get ahead is pervasive and contagious.

As you move through your research, figure out what propels the momentum of your users. How can you use this energy and the source of it to enhance your product offering?

3) Tap Into Self-Perceptions

In user research, interpreting body language is as important as understanding the spoken word. It is this space in between what a user says and how he or she behaves where insights and opportunity often emerge. In order to develop this empathy for your users it is important to understand how they perceive themselves with respect to others and within the context of what you are studying. However, understanding how a specific user perceives him or herself is difficult when you both don’t speak the same language and you are in a foreign culture where mannerisms and norms are different from your own.

Japan is a good example of a country where tapping into self-perceptions is key to understanding behaviors and attitudes towards products and services, but where it is also difficult for Westerners because of cultural and language barriers. The traditional Western conception of self is ego-focused and analytic, with an emphasis on stability. In contrast, the traditional Eastern conception of self is holistic and balance-focused—embracing contradiction and change. Of course, with increased world connectivity, lines are blurring between these values.

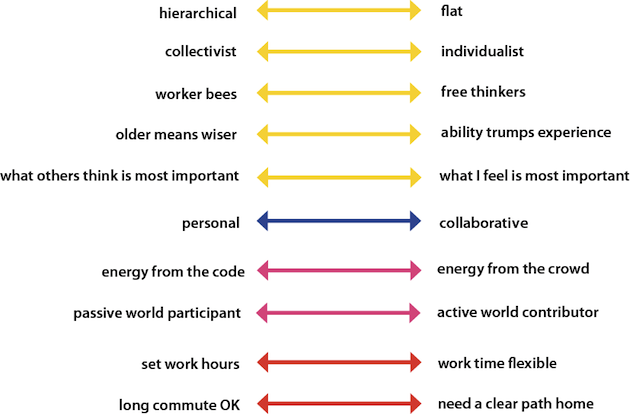

Creating a set of cultural spectrums pertaining to these differences and using them to structure user research can help draw out the direction and momentum of change that may affect your product.

Sample cultural spectrums used in Japanese field research. Creating spectrums specific to the culture you are studying and then using them as a guide with interviewees can help draw out self-perceptions. After you mark where each user falls along the spectrum, look at the results en masse to visualize overall trends and tendency towards change.

Experiment with methods such as culturally-derived spectrums to determine how your user group perceives itself. How can the results help you focus the direction of your research questioning or product placement? Getting to the heart of the response can help you understand how a user group views itself with respect to its neighbors and the world, and how these perceptions might affect your product.

4) Use Images as Language

In order to evoke high-level needs in locations where you have a language barrier, use images. Yes, often a translator or local partner is essential for both comprehension and trust-building, but everyone can respond to an image.

Set up an array of photographs and ask participants to select images that represent themselves and their aspirations. Additionally—if you have a good translator—you can try to ask participants which image is a metaphor for the specific product or service that you are researching in order to gain deep insight into their psyche.

The images selected by users in China (left), India (middle), and Japan (right), are all the result of a prompt asking them to select an image that represents their individual aspirations. Interestingly, many Chinese users chose cards that were nature-heavy. In the larger context of this study, this suggested a desire for healthy connections in their living and working environments. Indian respondents often picked images having to do with buildings and Japanese users often selected towards finding the energy and momentum in nature.

Again, getting to high-level needs related to your product or service is especially difficult with language barriers. So think about how you might use images to structure your questioning and read responses?

5) Know What You’re Up Against and Leverage It

Understand the cultural, economic, political, or other barriers that stand in the way of users adopting your product, and figure out how to use these constraints to your advantage.

For example, China structures its economy in a series of five-year economic plans. We are currently in the 12th five-year economic plan. Because change in China is top-down, and not bottom-up, it is the economic plan that dictates change. If your product or service is in-line with developments specified as necessary in the current economic plan, your chance of success is much greater than if it falls outside of the scope.

When faced with barriers to entry in the country you are working in, remember that change happens differently everywhere. How can you leverage constraints to your advantage?

Recap

Overall, user research and the subsequent UX, product, service, or experience design that follows is different in every country in the Asian market. As you launch new products or bring existing products to these markets, following these five guidelines may help you structure your study and move forward in the most successful direction.

Aerial Asia photo courtesy Shutterstock