Thinking of gamification we rarely associate it with financial services. However, it’s where this strategy was genuinely blooming throughout the centuries. Think of banking gamification as the opportunity to unlock rewards such as cashback, bonuses, and gifts for completing tasks, setting financial goals, and monitoring progress. All these elements are designed with a single mission – to grow customer loyalty, incentivizing users with various benefits of using financial services. The art of gamification is way older than we might imagine, and it’s deeply rooted in the banking sector.

Today, a bank in its traditional understanding has been replaced by digital alternatives, such as mobile banking apps, crypto apps, and fintech apps. Financial gamification is acquiring new forms and being rethought by mobile app designers in many exciting and creative ways. In this article, I am sharing a few fintech gamification practices and why they work out.

What Gamification Is All About?

Are you new to product gamification? Gamification is the technique of inserting game mechanics into non-game products. It’s the manifestation of care about the users, as the brand tries to make the product UX fun and entertaining, like a game. You can read more about the types of gamification here.

Why Gamification Matters

Higher conversion rates

A study by Finances Online says that companies that introduced gamification features to their products reach up to a 700% increase in conversion rates. From my own experience working with fintech startups, gamification can add to your product’s competitive edge and user retention a lot. Do we need to say more?

Improvement of the user’s financial health

Gamification might play a significant role in improving the financial health of users. For example, financial goals like healing the credit card debt or putting money aside for an important purchase can be achieved more easily if there is an in-app game mechanics allowing users to track their financial progress, celebrate small wins, and get rewards. In other words, fintech gamification can motivate people to engage in difficult tasks and reach their goals faster.

User engagement and loyalty

Enjoyable transactions, a strong motivation achieved through a progress bar, emotional reaction to funny badges and stickers are just a few factors to name that are building customer loyalty and increasing engagement.

4 Fintech App Gamification Practices and Why They Work Out

- Give people the avatars

Avatars are common social elements in gaming. You might want to allow users to customize their avatars with various traits fitting their self-image and temperament. Customization is an important factor affecting the user experience, especially when it comes to designing the avatar.

Why does it work out? We want to retain our right to authenticity and uniqueness even in the digital world. A personal avatar fully satisfies this demand, increasing social interaction and growing satisfaction from product usage.

- Gamify the onboarding and educational content

Fintech gamification is one of the ways to improve the financial literacy of users. Gamifying the onboarding process and educational content using illustrations and animations, mobile app owners can grow customer loyalty and help people to use their finances more effectively and make reasonable money decisions.

Why does it work out? What mobile app fingertips and onboarding screens have in common is their purpose to educate the user. As known, we learn better while playing. So, gamification can make the educational content easier to comprehend.

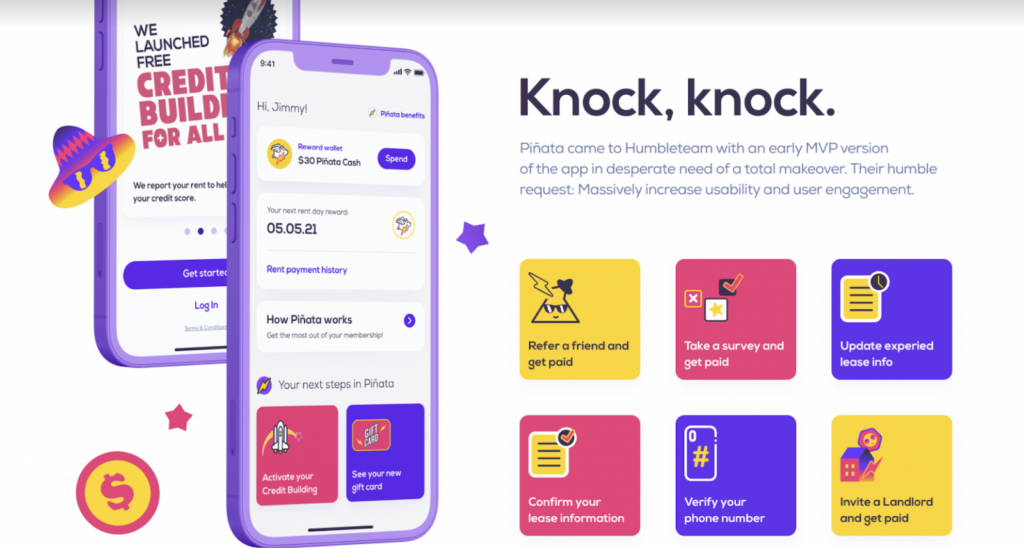

- Design multiple ways for users to get rewards

It’s not only a matter of product design but also marketing. Designing a well-thought-out reward program for users can be game-changing for product success and popularity. Product design and marketing are tightly related, so both teams must contribute to the creative process. People are attracted by rewards. Set the effort-fair challenges and reward users for completing them with stickers, badges, points, or bonuses.

Why does it work out? Interacting with a product for reward (like in a play-to-earn gaming model) creates the addictive feeling of fulfillment that motivates the user to take on a new challenge and level up their skills. It keeps the user engaged and prolongs the interaction with the product.

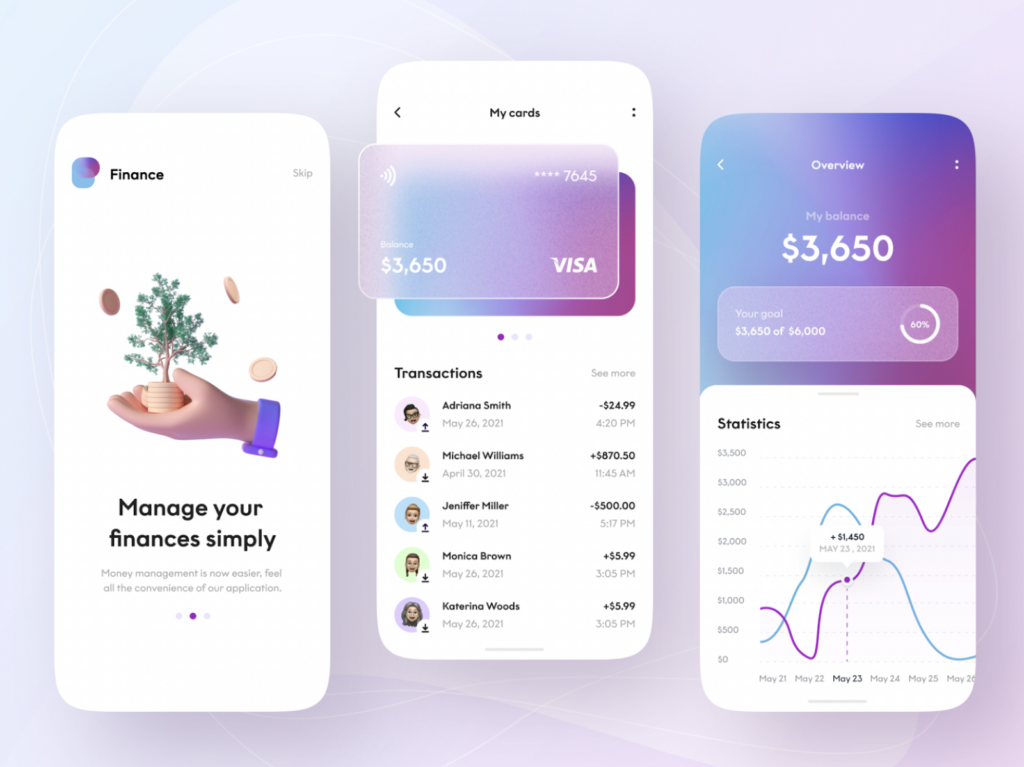

- Challenge your app users to meet goals

Setting the right challenges is not so easy. They should be neither simple nor too complicated. Imagine yourself playing a video game: if you face a simple task you’re bored. If it’s too complicated, it provokes dissatisfaction and aggression. Try to find the golden mean when creating in-app challenges. You can also fit a perfect balance by allowing users to set their objectives by themselves. A progress bar or a dashboard with personal statistics can do a great job for users keeping them on track with their goals.

Why does it work out? We’re competitive by our nature. One of the reasons for the addictiveness of games is that the tasks in the game pose a challenge to users. Tracking their progress on the way to a goal serves as self-motivation. The same psychological mechanism can work out in fintech app design, motivating people to achieve their financial goals.

Set The Right Goals For Fintech Gamification

To choose the game practice that will perform well for your product, you must clearly understand what results you want to achieve by implementing gamification. Otherwise, even beautiful games won’t help achieve KPIs and will just distract users from their true objectives. Consider the target user’s interests and motivations to design the experience that meets their demand and really engages them. I hope that these several fintech gamification ideas will help you build an amazing product that makes your customers happy.