Remember when online shopping was a novelty? Back then, buying something on the internet felt like an experiment. You’d wait days, sometimes weeks, for your order to arrive, unsure if it would even meet your expectations. Fast forward to today, and e-commerce has transformed retail in Southeast Asia, making online shopping a seamless, everyday habit for millions.

This transformation didn’t happen by accident — it required a keen sense of what might come next. Being able to look ahead, anticipating changes, and preparing for them before they happen. This is what we mean by foresight.

It’s not about guessing the future but thinking through different possibilities and adapting strategies based on what might unfold. In e-commerce, it’s about seeing shifts in technology, like how more people would shop through their phones, or predicting changes in consumer behavior, like the growing appeal of interactive and social shopping.

For e-commerce platforms in Southeast Asia, this meant looking beyond their borders, sometimes borrowing ideas from other markets, but always adapting them to local needs¹. They anticipated that a mobile-first approach would thrive in a region where over 90% of internet users are on smartphones².

They knew that making shopping feel fun and social — by adding live streams or games — would keep people coming back, even when they weren’t ready to buy³. And they adjusted their payment methods to fit markets with different banking habits, understanding that many customers would still prefer cash-on-delivery options.

Adapting to these challenges isn’t unique to e-commerce. Across industries, understanding localized contexts plays a critical role in designing solutions that resonate with users. For instance, tools created for small business owners require tailoring to their specific workflows and aspirations to ensure that the design aligns with their realities and goals. (See case study here.)

In e-commerce, this principle translates into finding ways for platforms to respond to declining purchasing power and shifting consumer habits while evolving to maintain dominance. Scenario analysis provides a valuable framework for anticipating which strategies will be most effective, particularly in today’s context of economic uncertainty.

The current state of e-commerce platforms reflects a scenario where decreasing purchasing power and large platforms dominate — a dynamic we refer to as the dominance of cost-efficient platforms.

In such scenarios, large e-commerce platforms have a better advantage because they can leverage economies of scale to offer competitive pricing while keeping consumers engaged through innovative features. Their ability to tailor payment options, such as Cash on Delivery (COD), further solidifies their foothold in cost-sensitive markets.

The struggle of traditional retailers in Indonesia’s economic downturn

As Indonesia faces its current economic situation, the urgency for traditional retailers to adapt cannot be overstated. With deflation occurring over five consecutive months earlier this year (May-September 2024), purchasing power remains strained, and the once-thriving middle class continues to face challenges, with many slipping into the lower-income bracket.

In this environment, traditional retailers — ranging from larger chain stores like Matahari Department Store, Ramayana, and Hypermart, to smaller, family-run shops and warungs, which have long been the backbone of Indonesia’s retail ecosystem — face a harsh reality. Their survival is at risk as they struggle to compete against large e-commerce platforms that are better equipped to handle economic downturns.

For these retailers, foot traffic has always been critical to sustaining business. Whether it’s the busy floors of a department store or a local warung thriving off neighborhood loyalty, the success of traditional retail has long depended on in-person interactions and immediate sales. However, during an economic downturn, fewer consumers are visiting physical stores, opting instead for the convenience and savings offered by online platforms⁴.

What does this mean for e-commerce platforms?

The balance of power tilts heavily in their favor. Platforms like Shopee, Lazada, and Tokopedia not only have the ability to offer more competitive pricing but also control vast logistics and distribution networks that allow them to reach consumers faster and more efficiently.

In a situation where purchasing power is low, this control over both cost and convenience makes them the preferred choice for consumers looking to stretch their budgets. On the other hand, traditional retailers, with their higher fixed costs (rent, staffing) and less flexible infrastructure, cannot compete as easily on price or convenience.

Navigating future scenarios

In light of these challenges, understanding the future of retail in Indonesia requires more than just looking at present trends — it involves planning for multiple possible futures.

Given the uncertainties in both purchasing power and market structures, we use a foresight framework, a strategic approach widely used by policymakers, business leaders, and innovators to anticipate a range of potential outcomes and assess long-term impacts on industries and societies. By helping decision-makers recognize and prepare for diverse possibilities, foresight enhances resilience and adaptability in uncertain environments. (See here for more details.)

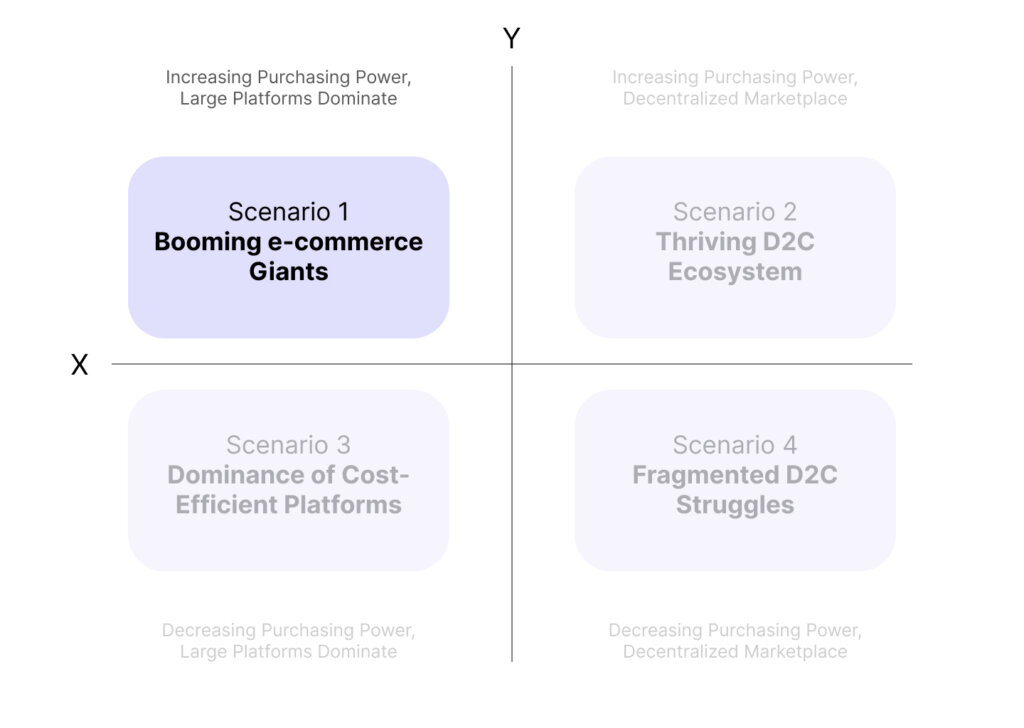

The matrix shown here offers a structured way to examine how different dynamics could unfold over time. The X-axis contrasts decentralized marketplaces on the right with markets dominated by large platforms on the left, while the Y-axis reflects consumer spending, ranging from increasing purchasing power at the top to decreasing purchasing power at the bottom.

With this framework in place, we can better understand how different futures might emerge and where Indonesia is likely to fit into these scenarios.

Scenario 1: booming e-commerce giants (increasing purchasing power, large platforms dominate)

In this scenario, consumers have more money to spend, and large e-commerce platforms dominate the market. Major platforms benefit from their scalability, offering both budget-friendly essentials and premium products. These giants thrive on their ability to provide efficient logistics, competitive pricing, and a vast range of offerings, from basic goods to luxury items.

Scenario 2: thriving D2C ecosystem (increasing purchasing power, decentralized marketplace)

Here, consumers seek unique and personalized products from Direct-to-Consumer (D2C) brands. With rising disposable income, consumers are willing to pay a premium for quality, niche products, or sustainability. Independent sellers and smaller brands thrive in this environment, relying on innovation, storytelling, and community-driven commerce to attract customers.

Scenario 3: dominance of cost-efficient platforms (decreasing purchasing power, large platforms dominate)

With declining purchasing power, consumers prioritize affordability, and large e-commerce platforms dominate. These platforms use economies of scale to offer lower prices, discounts, and payment flexibility like Buy Now, Pay Later (BNPL). They also engage consumers through entertainment-based shopping while optimizing logistics for fast, cost-effective delivery.

Scenario 4: fragmented D2C struggles (decreasing purchasing power, decentralized marketplace)

In this scenario, while purchasing power is low, the market is fragmented, with many small D2C brands struggling. Although consumers still seek affordable products, smaller sellers lack the infrastructure and scale of large platforms, leading to operational challenges. These brands focus on local or niche markets but face difficulties in maintaining profitability due to higher costs and logistical constraints.

Identifying Indonesia’s likely scenario

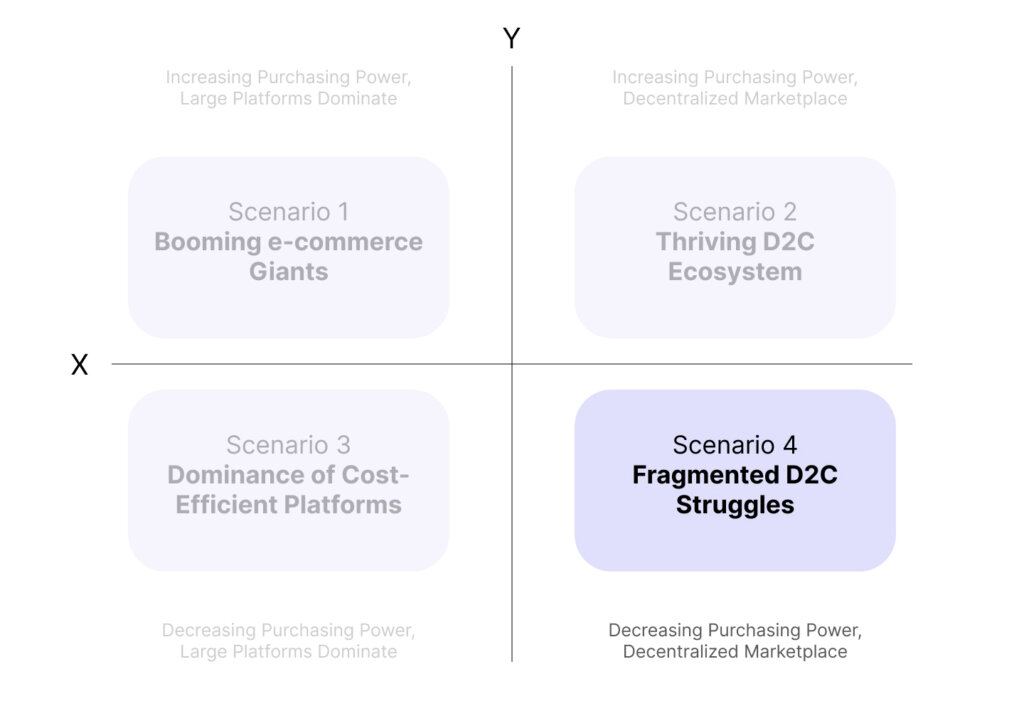

Given the current economic trends in Indonesia, two scenarios stand out as the most likely outcomes for the future of retail:

- Scenario 3: dominance of cost-efficient platforms

- Scenario 4: fragmented D2C struggles

Each scenario paints a different picture of how the market may evolve, based on whether large platforms maintain control or smaller, decentralized brands emerge as competitors.

Scenario 3: dominance of cost-efficient platforms (decreasing purchasing power, large platforms dominate)

Given the current state of decreasing purchasing power, Indonesia fits squarely into Scenario 3 — where large platforms dominate. E-commerce giants, with their ability to offer lower prices, have a natural advantage.

They can lean heavily on flash sales, deep discounts, and “Buy Now, Pay Later” (BNPL) solutions to attract consumers who are increasingly focused on affordability. Their ability to engage consumers through entertainment-driven experiences (like live-stream sales) is crucial to maintaining consumer attention, even as budgets shrink.

To maintain their advantage, large platforms must optimize their supply chains, invest in last-mile delivery, and offer faster, cheaper shipping options, which would be a key differentiator.

Establishing trust through scale: the role of large retail spaces in consumer perception

In today’s retail market, brand perception and consumer trust are key, especially when shoppers are cautious with spending. For larger stores, the sheer physical scale itself can convey an image of stability, reliability, and premium quality — qualities that are particularly appealing in economic downturns⁵.

This is the philosophy behind K3Mart’s flagship store in Jakarta, which doesn’t just sell products; it creates a full-fledged brand experience. With its “World’s Biggest Ramyeon Library,” featuring over 12,000 types of Korean ramen, K3Mart taps into Indonesian consumers’ love for Korean culture, particularly popular with younger, trend-conscious shoppers.

This immersion strategy is not just about the products on shelves; it’s about making the store a memorable destination where the brand feels larger-than-life and authoritative in its market presence.

Adding to this brand authority, K3Mart hosts events with prominent figures to generate buzz and strengthen consumer perception of K3Mart as an innovative and influential brand.

This approach resonates especially well with Gen Z, who value experiences and aspirational branding as much as they do products. The strategy of mixing physical retail with experiential elements fosters loyalty and a sense of exclusivity, encouraging customers to view K3Mart not just as a store but as a lifestyle brand that delivers on both quality and experience — an edge that sets it apart from ordinary retail spaces and reinforces consumer trust in the brand’s reliability and relevance.

Building on this approach, businesses can also take cues from other successful collaborations, such as Miniso’s partnerships with beloved brands like Harry Potter and Cinnamoroll. These collaborations leverage the popularity of iconic brands to draw in diverse consumer segments, sparking excitement and increasing foot traffic.

By aligning with globally recognized names, businesses could create similar co-branded experiences that merge their retail space with beloved cultural icons, enhancing their appeal and attracting loyal fans from these brands.

Staying competitive with omnichannel: how retailers meet modern demands

For traditional retailers to stay competitive, especially against digital-first platforms, an integrated omnichannel strategy and a strong physical presence have become essential. This is successfully demonstrated by MAP (Mitra Adiperkasa), Indonesia’s leading lifestyle retailer, with a vast portfolio including brands like Zara, Starbucks, and Sports Station.

MAP merges physical and digital shopping by offering services like click-and-collect, which allow customers to shop online and pick up their items in-store. While home delivery remains a popular option, click-and-collect offers benefits such as avoiding delivery fees, obtaining last-minute purchases quickly, and allowing customers to inspect items in-store for easier returns.

This omnichannel approach resonates particularly well with Millennials and Gen Z consumers. Studies indicate that channel seamlessness significantly enhances younger consumers’ positive attitudes toward omnichannel shopping⁶.

Recognizing this, omnichannel retailers like MAP have prioritized achieving channel consistency and seamless integration, which not only improves the customer experience but also operational efficiency⁷. For instance, the introduction of such strategies helps retailers reduce inventory risks by optimizing total order quantities and streamlining supply chain management.

In addition, MAP’s mobile app elevates the experience by helping customers secure deals through sale tracking and exclusive membership benefits. With its tiered membership system, shoppers can earn points on purchases, which they can later redeem for rewards — an attractive feature for promo hunters⁸.

By combining practical conveniences like seamless channel integration with loyalty-building incentives, MAP strengthens customer satisfaction and engagement, creating a shopping experience tailored to the expectations of today’s tech-savvy and value-driven consumers.

A tailored approach: building loyalty across ages

Meeting the diverse expectations of different age groups and socioeconomic classes is essential for success in today’s retail landscape. Younger consumers, who are digitally savvy, prefer flexibility and convenience, and MAP’s digital offerings — such as online shopping, mobile access to deals, and cross-brand gift cards — cater to this audience’s need for variety and spontaneity.

These digital gift cards, usable across brands from Starbucks to Massimo Dutti, foster an ecosystem of choice within MAP’s portfolio, allowing younger customers to explore and experience flexibility without committing to a single brand or outlet.

For older, more established consumers, MAP emphasizes service quality and reliability⁹. This demographic values trusted in-store experiences and established brands but appreciates the convenience of digital enhancements that bridge in-store and online interactions.

By integrating digital experiences across its portfolio, MAP ensures that customers enjoy consistent standards of service and product quality, whether shopping at SOGO in-store or online. This blend of digital adaptability and physical presence helps traditional retailers like MAP and K3Mart remain resilient amid Indonesia’s challenging economic landscape.

This approach not only creates a unified, flexible ecosystem that resonates across age groups but also ensures they remain competitive by appealing to Indonesian consumers’ evolving expectations for both cost efficiency and trustworthy, immersive brand experiences.

Driving spending and loyalty through retail and credit card alliances

In today’s competitive retail landscape, branded credit cards have become a powerful tool for both retailers and financial institutions, offering significant advantages in customer loyalty, spending habits, and brand engagement. MAP (Mitra Adiperkasa) exemplifies this strategy through its partnership with BNI, introducing the MAP-BNI co-branded credit card.

This card provides exclusive benefits — loyalty points, cashback, member-only sales, and special discounts across MAP’s vast retail portfolio. Such benefits create a seamless rewards ecosystem that keeps customers engaged within the MAP network.

Studies indicate that credit card holders tend to spend more than cash users due to the convenience and flexibility offered by credit, with some research suggesting a significant increase in spending compared to cash transactions¹⁰. In Indonesia, this trend is evident as credit card transactions rose by 32% in 2022 alone, signaling the rising influence of credit in driving consumer spending¹¹.

This effect is amplified with co-branded cards, where consumers feel encouraged to shop more frequently to accumulate points and access perks. The MAP-BNI card’s tiered rewards structure, which allows customers to redeem points for discounts and exclusive products, caters to value-conscious consumers, such as promo hunters, who actively seek to maximize rewards. This ongoing engagement fosters repeat visits, embedding MAP into customers’ everyday lives and solidifying brand loyalty.

For MAP, the strategy boosts sales and positions the brand as a preferred choice in customers’ shopping routines.

For BNI, this collaboration opens access to MAP’s dedicated customer base, increasing transaction volumes and extending the bank’s reach to a retail-focused demographic.

The MAP-BNI credit card becomes a touchpoint of engagement, enhancing customer loyalty while expanding BNI’s brand influence within MAP’s loyal customer community.

Scenario 4: decreasing purchasing power, decentralized marketplace (fragmented D2C struggles)

In this scenario, smaller Direct-to-Consumer (D2C) brands find themselves in a difficult position as consumer spending decreases. Brands in Indonesia, particularly in sectors like fashion, beauty, and lifestyle — for example, Sare Studio (modest fashion), Wardah Cosmetics, and Nama Beauty — have built strong identities around personalization, authenticity, and community-driven commerce.

However, with the current economic challenges, they struggle with high operational costs and logistical constraints that make it difficult to compete on price and convenience against larger e-commerce platforms.

Living the brand: immersive strategies for D2C top-of-mind impact

D2C brands are redefining their market presence by shifting from transactional relationships to immersive lifestyle experiences. This approach enables them to connect deeply with consumers and capture a larger share of the market by tapping into diverse lifestyle values.

Wardah Cosmetics, for example, might partner with eco-friendly brands like Sare Studio for sustainability-driven campaigns, allowing both brands to reach like-minded audiences and amplify their message of conscious living. These partnerships not only pool resources but also expand reach beyond traditional e-commerce platforms.

Brands are further enhancing their lifestyle appeal by weaving experiential elements into their offerings. Take Saturdays NYC, which seamlessly integrates eyewear retail with coffee culture, or Oppo’s Finders Cafe, combining tech with a social café experience. Similarly, beauty and wellness brands in Indonesia are blending into health-conscious spaces, collaborating with yoga studios, fitness centers, or running groups.

Wardah Cosmetics could offer skincare samples or discounts for yoga students, while Nama Beauty might co-host wellness events, aligning beauty with health in a way that resonates with today’s lifestyle-driven consumers. Such co-branded events create meaningful, memorable experiences that build deeper brand loyalty¹².

This shift isn’t confined to smaller D2C brands. Established names like Blibli and Tiket.com are leading through initiatives like the EcoTouch “Fashion Take Back” program, which repurposes fashion waste into sustainable materials. Collaborations like these enable them to support the movement toward eco-conscious practices, aligning their brand with lifestyle values that resonate with their audiences¹³.

From large-scale initiatives to intimate D2C partnerships, these strategies meet consumers in spaces where brand interactions and lifestyle values converge, enhancing loyalty and presence across market segments.

Engaging customers with purpose: the bartering model as a brand advantage

During the pandemic, online bartering emerged as a creative solution for consumers looking to exchange goods without spending cash, highlighting a shift towards community-driven, sustainable commerce.

Platforms like Facebook Marketplace became popular hubs for these exchanges, and specialized platforms like Nextbarter have since expanded the concept, allowing businesses to trade surplus products or services for needed resources, all while reducing expenses. This approach aligns well with today’s eco-conscious values, appealing to consumers who appreciate brands that embrace resourceful, environmentally friendly practices.

The appeal goes beyond physical goods. Platforms like Instagram, already popular for unique, niche items — from vintage gold to bespoke fashion — have shown the demand for one-of-a-kind alternatives to mass-produced products.

For D2C brands, this shift means they can offer exclusive bartering options, where customers might trade not only items but also services or specialized skills in exchange for limited-edition products, event spots, or brand experiences. Whether it’s your handmade crafts, expert services, or unique offerings, these exchanges foster a sense of community and exclusivity.

Preparing for what’s ahead

Anticipating challenges before they emerge is key to staying competitive in Indonesia’s fast-paced, evolving business environment. While technology develops rapidly, offering numerous digital tools and strategies, the real value lies in knowing when and how to implement them.

It’s not just about adopting the latest innovations; it’s about assessing if the market and economic conditions are ready for these solutions. Being strategic and thoughtful ensures that businesses don’t just react to change, but actively shape their future.

In this ever-changing landscape, success requires more than just innovation — it calls for strategic foresight. Companies need to evaluate the intersection of technology, market readiness, and consumer behavior to determine which strategies will work in a complex, dynamic environment.

By being agile and focused on real-world applicability, businesses can create ecosystems that are not only forward-thinking but also adaptable to the challenges and opportunities that lie ahead.

- ¹ Ayob, Abu, et al. “E-commerce adoption in ASEAN: who and where?”. Future Business Journal, vol. 7, no. 1, 2021. https://doi.org/10.1186/s43093-020-00051-8

- ² “Analysis of the most widely used e-wallet and e-commerce portals in Indonesia based on the pillars of digital economy”. Nusantara Science and Technology Proceedings, 2022. https://doi.org/10.11594/nstp.2022.2605

- ³ Thuy An Ngo, Thi, et al. “The effects of social media live streaming commerce on Vietnamese generation Z consumers’ purchase intention”. Innovative Marketing, vol. 19, no. 4, 2023, p. 269–283. https://doi.org/10.21511/im.19(4).2023.22

- ⁴ Belbağ, Aybegüm G., et al. “Impacts of COVID-19 pandemic on consumer behavior in Turkey: a qualitative study”. Journal of Consumer Affairs, vol. 56, no. 1, 2021, p. 339–358. https://doi.org/10.1111/joca.12423

- ⁵ “The impact of impulsive purchasing behavior on consumer actual consumption during an economic crisis: evidence from essential goods in the retail industry, Sri Lanka”. SLIIT Business Review, vol. 3, no. 1, 2024, p. 43–64. https://doi.org/10.54389/haia8535

- ⁶ Ryu, Jay S., et al. “Understanding omnichannel shopping behaviors: incorporating channel integration into the theory of reasoned action”. Journal of Consumer Sciences, vol. 8, no. 1, 2023, p. 15–26. https://doi.org/10.29244/jcs.8.1.15-26

- ⁷ Wang, H., Zhang, W., & He, Y. (2022). Optimal ordering decisions for an omnichannel retailer with ship‐to‐store and ship‐from‐store. International Transactions in Operational Research, 31(2), 1178–1205. https://doi.org/10.1111/itor.13181

- ⁸ Kim, Su, et al. “The effects of adopting and using a brand’s mobile application on customers’ subsequent purchase behavior”. Journal of Interactive Marketing, vol. 31, no. 1, 2015, p. 28–41. https://doi.org/10.1016/j.intmar.2015.05.004

- ⁹ Tomazelli, Joana B., et al. “The effects of store environment elements on customer-to-customer interactions involving older shoppers”. Journal of Services Marketing, vol. 31, no. 4/5, 2017, p. 339–350. https://doi.org/10.1108/jsm-05-2016-0200

- ¹⁰ Soll, Jack B., et al. “Consumer misunderstanding of credit card use, payments, and debt: causes and solutions”. Journal of Public Policy &Amp; Marketing, vol. 32, no. 1, 2013, p. 66–81. https://doi.org/10.1509/jppm.11.061

- ¹¹ “Card Payments in Indonesia to Grow by 39.6% in 2022, Forecasts GlobalData.” GlobalData, 18 Oct. 2022, www.globaldata.com/media/banking/card-payments-indonesia-grow-39-6-2022-forecasts-globaldata/. Accessed 03 Dec. 2024.

- ¹² Hultén, Bertil, et al. “Sensory cues and shoppers’ touching behaviour: the case of IKEA”. International Journal of Retail & Distribution Management, vol. 40, no. 4, 2012, p. 273–289. https://doi.org/10.1108/09590551211211774

- ¹³ Khandai, Sujata, et al. “Ensuring brand loyalty for firms practising sustainable marketing: a roadmap”. Society and Business Review, vol. 18, no. 2, 2022, p. 219–243. https://doi.org/10.1108/sbr-10-2021-0189

The article originally appeared on Medium.

Featured image courtesy: bluejeanimages.