Save

Constraints are powerful clues, limiting the set of possible actions. The thoughtful use of constraints in design lets people readily determine the proper course of action, even in a novel situation. — Don Norman, The Design of Everyday Things

Constraints are core to good product design. Consider the menu at Chipotle (burrito/bowl/salad/tacos), an example of a retailer thats grown sales by helping users avoid the “paradox of choice.” Or a car angrily beeping when you start driving without a seat belt, an example of a hardware manufacturer helping users drive more safely.

When it comes to digital products, many have a clean, simple visual design (one form of constraint), on top of an utterly unconstrained, sprawling mess of functionality underneath. With digital products, when adding a new feature can be as easy as adding a few lines of code — and when users say they really want that new feature — why wouldn’t you add it?

You might not add it because, perhaps, the short-term benefit from that feature is actually at odds with users’ long-term interests. This brings us to a particularly interesting type of constraint: those that cause users short-term dissatisfaction, but help users make better long-term decisions. In this post, we’ll explore four digital products that do just that, drawn from hiring, gaming, investing, and publishing.

Lever: The Group-Think Constraint

Lever is a SaaS product that helps teams hire better. Lever’s default settings around around job applicant interview feedback are particularly opinionated, and constrained.[1] After completing an interview, Lever prompts the interviewer to submit feedback on the candidate. There are two constraints in the default way feedback is solicited, constraints that have made me uncomfortable as an interviewer — but also helped me make better decisions.

First, each candidate must be scored on a scale of 1 (“strong no”) to 4 (“strong yes”). At most companies, 3 means “yes, I support hiring this candidate” and 2 means “no, I do not”. Due to the even-numbered scale, there is no “neutral” rating. The lack of a neutral rating forces the interviewer to support one of two potential actions (hire or don’t hire); it raises the stakes.

This brings us to the second constraint. In this high-stakes decision, where I have to “take a side” as an interviewer, sometimes I don’t have a strong opinion on the candidate. I’m uncertain, and I want to avoid “getting it wrong” — being the lone panelist with a rating that deviates from the rest of my colleagues on the panel. In these situations, I want to see what the other panelists have rated the candidate, and align my rating with theirs. But Lever doesn’t let you do this! Other interviewers’ scores are hidden until you submit your own feedback, even if you’re the hiring manager.

This design is uncomfortable for many interviewers — but it leads to better hiring decisions. In Noise, psychologist Daniel Kahneman and legal scholar Cass Sunstein explore how aggregating individuals’ judgments can generate better decisions, but only if the information flow is gated, to ensure judgements truly are independent.[2] Using Google as an example, before Lever helped promote this strategy more widely, they write:

Almost all companies aggregate the judgments of multiple interviewers on the same candidate…. To ensure [a high] level of validity [around the panel’s assessment of a candidate], however, Google stringently enforces a rule that not all companies observe: the company makes sure that the interviewers rate the candidate separately, before they communicate with one another. Once more: aggregation works — but only if the judgments are independent.

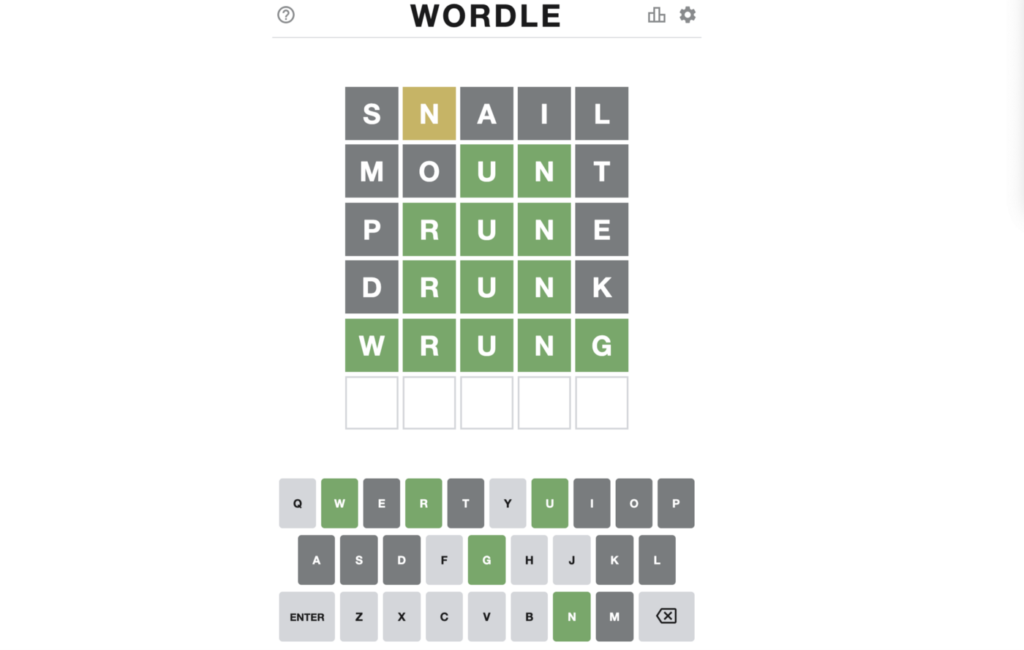

Wordle: The Binging Constraint

Wordle is a game in which you try to guess a 5-letter word. Never 4, never 6, always 5. It was created by a solo developer (Josh Wardle) in October 2021, as a gift for his partner, not a business endeavor. Its popularity exploded in December and January, with millions of users by late January.

My wife introduced Wordle to me two weeks ago. It took me about 10 minutes to solve my first puzzle, with her coaching me over my shoulder. Excited to have solved it, I asked her how to advance to the next puzzle. “That’s it,” she said “there’s one Wordle per day. You can try the next one tomorrow.” I was surprised, annoyed — and intrigued.

“Making Wordle I specifically rejected a bunch of the things you’re supposed to do for a mobile game,” [game creator] Wardle told NPR. He deliberately didn’t include push notifications, allow users to play endlessly or build in other tools commonly used today to pull users into playing apps for as long as possible.

Wardle said the rejection of those engagement tricks might have fueled the game’s popularity after all — “where the rejection of some of those things has actually attracted people to the game because it feels quite innocent and it just wants you to have fun with it.” (source)

I’m now two weeks into playing Wordle, and it’s become a daily habit. But I don’t feel bad about it — because it’s not something I can binge. It’s just 5–10 min each day, never more than that. Playing Wordle feels wholesome and healthy; it’s a little thing to look forward each day, something I know will never turn into “doom scrolling.”

And while I don’t know this for sure, since specific numbers on Wordle users are hard to come by, I’d bet that the “one game per day” constraint has been key to the game’s growth.

Vanguard: The Gambling Constraint

When we purchased our home, I sold a chunk of shares in Vanguard’s S&P500 ETF for our down payment. About two weeks later, after the home had closed, it turned out we had withdrawn a bit too much from the ETF. So I logged back into Vanguard’s website and placed an order to transfer the surplus funds back into the S&P500 ETF. I was surprised to see Vanguard reject my buy order. An error message informed me that after a user sells shares in a particular ETF, Vanguard freezes that user’s ability to buy shares in the same fund for the next 30 days.

Vanguard’s Frequent-trading policy: If you sell or exchange shares of a Vanguard fund, you will not be permitted to buy or exchange back into the same fund, in the same account, within 30 calendar days.

I was puzzled. Why would Vanguard freeze me out for 30 days? On Robinhood or Coinbase, I can trade in and out of the same fund or asset every day — or every hour. Clearly the technology exists to support extremely frequent consumer trading. And why wouldn’t Vanguard want me trading more? More trades means more user engagement means more customer lifetime value, right?

As I puzzled over this, I went down a Wikipedia rabbit hole that led me to the philosophy of Vanguard founder, Jack Bogle. He evangelized a simple, long-term-oriented approach to investing: put your money into US equity and bond index funds, rebalance no more than once a year, and choose the asset manager with the lowest fees. He founded Vanguard to provide those low fees. The whole Vanguard platform was built to deliver on this value proposition — if you buy and hold, you can do so with extremely low fees. The company’s value proposition is not to help users beat the market, but rather to allow them to participate in the market (for better or worse) at low cost.

Now this “no trades for 30 days” constraint started to make more sense. It was Vanguard’s intentional and necessary way of differentiating itself from a platform like Robinhood, where the explicit value proposition is “low cost trades” and the implicit value proposition is “use this platform to beat the market.” The short-term frustration that Vanguard imposed on me were a useful reminder of what Vanguard was — and was not — and how I should be using their product: investing to participate in the market, at low cost.[3]

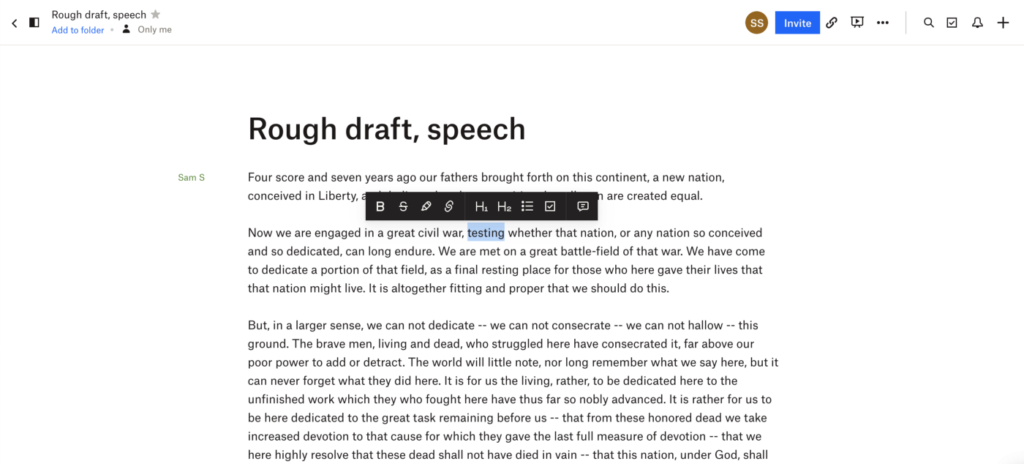

Dropbox Paper: The Tweaking Constraint

Paper is Dropbox’s document creation and collaboration tool, ostensibly similar to Google Docs or Microsoft Word. I first used Paper in 2019, and I was shocked to find it lacked features I had come to take for granted in a writing tool: the ability to choose a font. To set margins. To number pages (or even to have pages).

Without these formatting options, the only thing I could to do with Paper was… write. The lack of functionality focused me entirely on the core of the task: producing clear and concise prose. At first, this was intimidating. I had become used to playing around with formatting when I hit a roadblock in my writing. But there was no such tweaking to distract me when using Paper. Just the half-finished paragraph with which I was struggling. Over time, I learned to love this enforced focus; the knowledge that I couldn’t change the formatting, even if I wanted to, was freeing.

(For what it’s worth, Medium’s writing interface is similarly sparse and a major reason I write this blog on Medium!)

We’re all subject to biases. Sometimes they’re shortcuts we take to make hard decisions feel easier. Sometimes they’re tricks we play on ourselves to justify short-term pleasures that carry with them long-term costs.

Daniel Kahneman calls this “fast thinking” and “slow thinking”; it’s easier to rely on mental shortcuts (fast thinking), but when we slow down and think things through, we tend to make better decisions. Some product design takes advantage of fast thinking. For example, the “autoplay next episode” feature on Netflix drives a lot of short-term user engagement, but in the long-term, it can leave you feeling wary of Netflix.

Other products, like the ones described above, take the opposite approach. They help users slow down, think a bit deeper, and make decisions that are better. This may come at a cost to short-term user satisfaction, but the plethora of successful products that embrace such constraints (which is certainly not limited to Lever, Wordle, Vanguard, and Dropbox), proves it can be a long-term winning strategy.

Footnotes

- The Lever settings described can be turned off by company administrators, but not by end users (hiring managers, interviewers).

- Sunstein is also the co-author of Nudge, along with Richard Thaler. Nudge is about “choice architecture”: how to help people make better decisions for themselves. This blog post on constraints is focused on a subset of that field.

- Vanguard is not the only asset manager to impose a 30-day trading limit after ETF and mutual fund sales; Fidelity has a similar constraint.

Sam Stone

Sam Stone is currently the Director of Product Management for Pricing and Machine Learning at Opendoor, a real estate technology company that uses algorithms to buy and sell homes instantly, saving homeowners the hassle and uncertainty of the traditional home sale process. Prior to Opendoor, he was a co-founder and Product Manager at Ansaro, a SaaS startup using data science to improve the fairness of enterprise hiring processes. Earlier in his career, Sam worked at genomics software startup SolveBio, investment firm TPG, and consulting firm Bain & Company. He holds degrees in Math and International Relations from Stanford and an MBA from Harvard.

- Constraints are crucial and important for good product design.

- The author explores 4 digital products with constraints that cause users short-term dissatisfaction, but help users make better long-term decisions:

-

- Lever: The Group-Think Constraint

- Wordle: The Binging Constraint

- Vanguard: The Gambling Constraint

- Dropbox Paper: The Tweaking Constraint